The Families First Coronavirus Response Act (FFCRA) was signed into law on March 18, 2020, in response to the challenges brought forth by the COVID-19 pandemic. The FFCRA introduced relief for self-employed taxpayers who could not work or telework due to COVID-19 between April 1, 2020, and December 31, 2020, in the form of refundable sick leave and family leave tax credits. The FFCRA established the foundation for determining who is eligible and how the tax credits are calculated.

The Consolidated Appropriations Act (CAA) extended the 2020 tax credit period from December 31, 2020, to March 31, 2021. The American Rescue Plan (ARP) Act then introduced the 2021 tax period beginning April 1, 2021, and ending September 30, 2021.

Legislation | Date Signed | Tax Credits Affected | Eligible Time Periods |

|---|---|---|---|

Families First Coronavirus Act (FFCRA) | March 18, 2020 | Sick and Family Leave Tax Credits | April 1, 2020 – December 31, 2020 |

Consolidated Appropriations Act (CAA) | December 27, 2020 | Sick and Family Leave Tax Credits | Extended to April 1, 2020 – March 31, 2021 |

American Rescue Plan (ARP) Act | March 11, 2021 | Sick and Family Leave Tax Credits | Introduced April 1, 2021 – September 30, 2021 |

What Is the Self-Employed Tax Credit (SETC)?

The Self-Employed Tax Credit (SETC) refers to the sick leave and family leave tax credit provisions for self-employed individuals introduced under the FFCRA. The SETC allows qualified self-employed workers to recover up to $32,220 for 2020 and 2021.

Who Is Eligible for the SETC Tax Credit?

Eligible self-employed individuals are generally those who meet the following three criteria:

- You identify as a self-employed individual (e.g., sole proprietors, freelancers, independent contractors, and gig workers). See examples below.

- Accountants and Bookkeepers

- Airbnb Hosts

- Amazon Resellers

- Copywriters

- Construction Workers

- Consultants

- Dentists

- Graphic Designers

- General Practitioners

- Personal Trainers

- Photographers

- Rideshare and Delivery Drivers

- Real Estate Agents

- Social Media Marketers

- Veterinarians

- Website Designers and Developers

- You filed a Schedule SE (IRS Form 1040) for 2020 or 2021, reported a positive net income, and paid self-employment taxes on your earnings.

- You could not work or telework in 2020 or 2021 due to COVID-19.

How Are SETC Refunds Calculated?

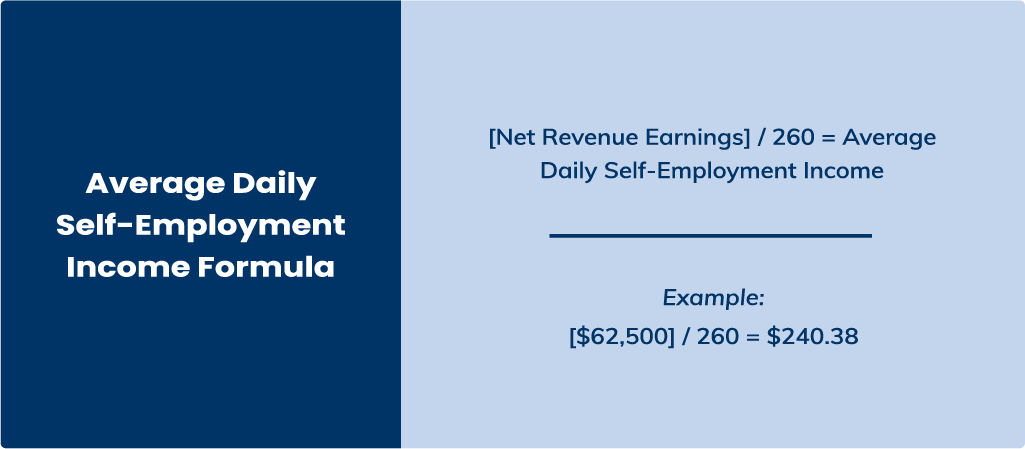

Tax credits provided under the FFCRA for self-employed individuals are equal to the qualified sick leave and family leave equivalent amounts that eligible employers can claim.

Qualified Sick Leave Equivalent Amount

The qualified sick leave equivalent amount applies to self-employed individuals who are unable to work or telework due to:

- being subject to a federal, state, or local quarantine or isolation order due to COVID-19,

- being advised by a healthcare provider to self-quarantine due to COVID-19, or

- experiencing COVID-19-related symptoms and seeking a medical diagnosis.

Under the Emergency Paid Sick Leave Act (EPSLA) provision of the FFCRA, individuals may claim the lesser of $511 per day or 100% of their average daily self-employment income per day. A total of 20 days may be considered: 10 days for the period between April 1, 2020, and March 31, 2021, and 10 days for the period between April 1, 2021, and September 30, 2021.

Qualified Family Leave Equivalent Amount

The qualified family leave equivalent amount applies to self-employed individuals who are unable to work or telework due to:

- caring for an individual who is subject to a quarantine or isolation order related to COVID-19, or

- caring for a child if their school is closed or childcare provider is unavailable due to COVID-19.

Under the expanded Family and Medical Leave Act (FMLA) provision of the FFCRA, individuals may claim the lesser of $200 per day or 67% of their average daily self-employment income per day. A total of 110 days may be considered: 50 days for the period between April 1, 2020, and March 31, 2021, and 60 days for the period between April 1, 2021, and September 30, 2021.

Tax Credit | Maximum Number of Days | Maximum Amount Per Day | Maximum Value Overall |

|---|---|---|---|

Sick Leave Credit (April 1, 2020 – March 31, 2021) | 10 | $511 | $5,110 |

Sick Leave Credit (April 1, 2021 – September 30, 2021) | 10 | $511 | $5,110 |

Family Leave Credit (April 1, 2020 – March 31, 2021) | 50 | $200 | $10,000 |

Family Leave Credit (April 1, 2021 – September 30, 2021) | 60 | $200 | $12,000 |

Are There Any Limitations to the SETC?

Yes, in addition to the eligibility criteria, there are a few limitations of the SETC to be aware of.

- You will not receive the full SETC amount if you already received wages from an employer for sick or family leave in 2020 or 2021. Your SETC portion will be reduced by the wages you received.

- You will not receive the full SETC amount if you received unemployment benefits in 2020 or 2021. Your SETC calculation must exclude these days.

- You must be a U.S. citizen, permanent resident, or qualifying resident alien.

How Do I Apply for the SETC?

1st Capital Financial’s self-service platform is the easiest, fastest, and most secure way for individuals to apply for the SETC.

Using 1st Capital Financial’s Self-Service Platform

- Confirm Your Eligibility for the SETC. Use our pre-qualification survey to determine your eligibility and calculate your estimated SETC amount.

- Gather Your Tax Statements and Identification. We need information on the dates and reported income from your 2020 and 2021 tax statements and a copy of your driver’s license or passport.

- Complete Your SETC Application. Answer the questions provided, upload your ID, sign a few documents, and select your preferred payment method for the processing fee.

- Await Your Check or Direct Deposit (ACH). The IRS will process your claim and issue a refund via check or direct deposit (ACH) based on your preferences.

FAQs About the SETC and the FFCRA

Yes, two deadlines apply to the amended tax returns required for your claim. The deadline for your 2020 amended tax return is April 15, 2024. This deadline applies to the period between April 1, 2020, and March 31, 2021, and accounts for $15,110 of the SETC value. The deadline for your 2021 amended tax return is April 15, 2025. This deadline applies to the period between April 1, 2021, and September 30, 2021, and accounts for $17,110 of the SETC value.

No, the SETC is not a loan or grant. The funds you receive from the SETC are a refund against the taxes you have already paid or owe. These tax credits are intended to compensate you for the income you have lost due to COVID-19.

It can take up to three weeks for the IRS to acknowledge their acceptance of your SETC claim and 20 weeks for the IRS to process your SETC claim and issue your checks or direct deposit. However, our clients typically receive their refund in about nine weeks. Clients who opt for direct deposit may receive their refund even sooner.

The “SETC” is a colloquial term that refers to the provisional sick and family leave tax credits for self-employed individuals introduced under the FFCRA. There is no difference otherwise.

The IRS considers self-employed individuals to be those whom the following applies:

- You carry on a trade or business as a sole proprietor or an independent contractor.

- You are a member of a partnership that carries on a trade or business.

- You are otherwise in business for yourself (including a part-time business or a gig worker).

A Schedule SE tax form is one of the schedules in an IRS Form 1040 (“U.S. Individual Income Tax Return”). A Schedule SE is used to calculate individuals’ total self-employment taxes. Self-employment taxes include Social Security and Medicare taxes, similar to those withheld for W-2 employees.

An IRS Form 1040-X is an “Amended U.S. Individual Income Tax Return.” Since the FFCRA’s sick leave and family leave tax credits for self-employed individuals now have to be claimed retroactively, claimants must also amend their income tax returns.

Note: When you use 1st Capital Financial’s SETC Self-Service Platform, your IRS Form 1040-Xs are filed on your behalf.

An IRS Form 7202 is the core document used to claim sick leave and family leave tax credits for self-employed individuals. 7202s are meant to detail self-employed individuals’ eligibility and tax credit calculations.

Note: When you use 1st Capital Financial’s SETC Self-Service Platform, your IRS Form 7202 is filed on your behalf.

A Valuable Opportunity for Self-Employed Workers

The FFCRA’s self-employed tax credits are a valuable opportunity for freelancers, gig workers, independent contractors, and sole proprietors who were unable to take advantage of other COVID relief programs like the Paycheck Protection Program (PPP), Economic Injury Disaster Loan (EIDL), or Employee Retention Credit (ERC). 1st Capital Financial is proud to offer a self-service platform that ensures your calculations are done correctly and all the necessary documentation to support your claim is included. However, these tax credits will only be available for a limited time! Do not wait to find out if you qualify. Take our pre-qualification survey today to get started.

Get Started Using Our SETC Self-Service Platform