Update For Our Clients

Introducing the Self-Employed Tax Credit

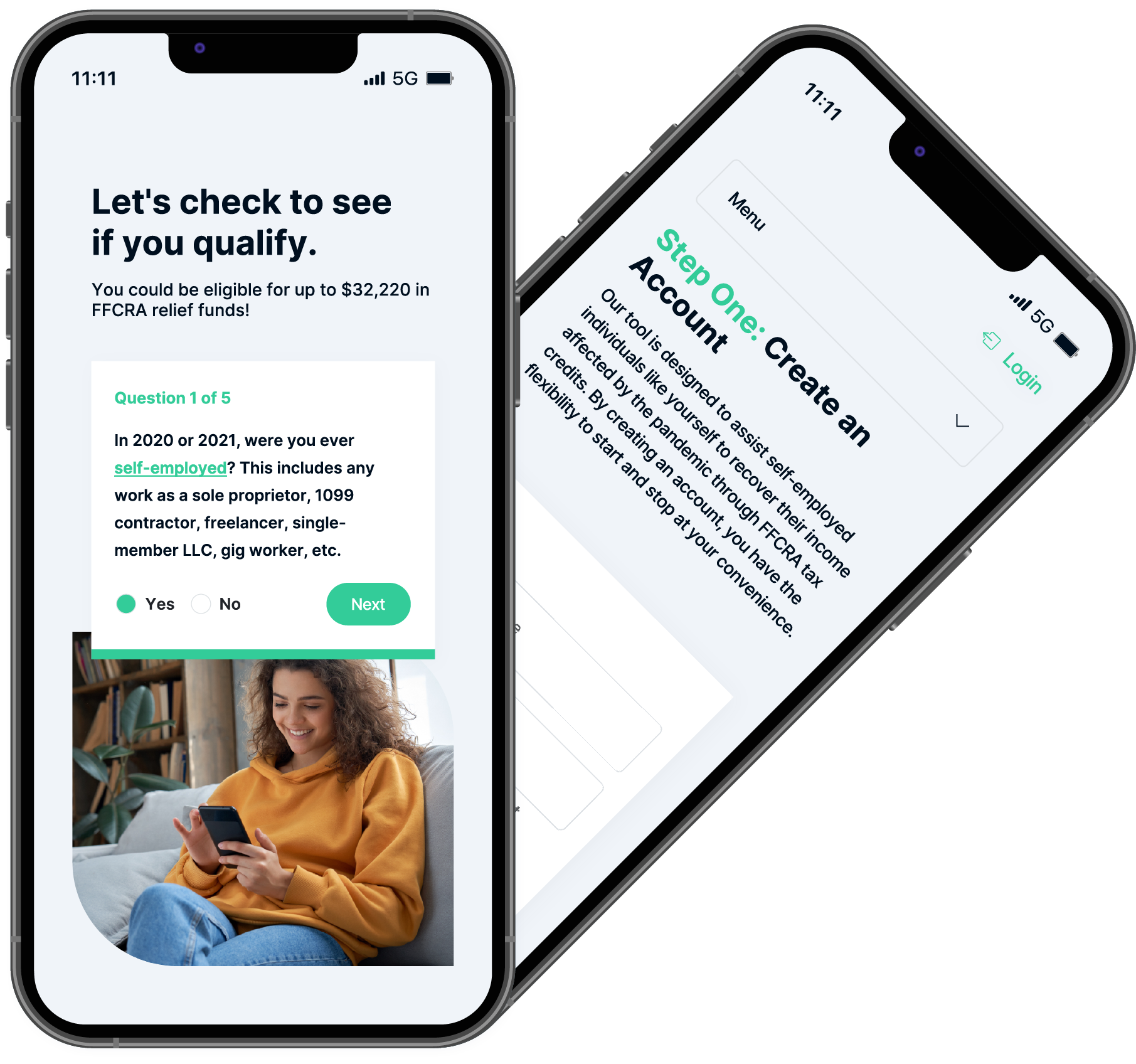

1st Capital Financial’s SETC Self-Service Platform is the easiest, fastest, and most secure way for individuals to claim their FFCRA self-employed tax refund. Take our pre-qualification survey online to get started.

Apply Risk-Free With Our Money-Back Guarantee ¹

Claim Your SETC Tax Credit With Our 100% Online Tool

Easy, Fast, and Accessible

Patent-Pending Technology

Accurate and Compliant

SETC Tax Credit Overview

What Is the SETC Tax Credit?

The Families First Coronavirus Response Act (FFCRA) is a federal law (Public Law No. 116-127) that provides self-employed individuals with tax credits that reimburse them, dollar for dollar, for the cost of being unable to work due to COVID-related issues.

The Self-Employed Tax Credit (SETC) refers to the provisional sick and family leave tax credits for self-employed individuals introduced under the FFCRA in March 2020.

At A Glance

Self-employed individuals who had to take time off in 2020 or 2021 because of COVID-19 are likely to qualify for the SETC tax credits provided by the FFCRA.

At A Glance

SETC Tax Credit Eligibility

Who Is Eligible for the SETC Tax Credit?

Accountants and Bookkeepers

Airbnb Hosts

Amazon Resellers

Copywriters

Construction Workers

Consultants

Dentists

Graphic Designers

General Practitioners

Personal Trainers

Photographers

Rideshare and Delivery Service Drivers

Real Estate Agents

Social Media Marketers

Veterinarians

Website Designers and Developers

How To Claim Your SETC Tax Credit

Using Our SETC Self-Service Platform

FAQs About the FFCRA, SETC, and Our Self-Service Platform

Frequently Asked Questions, Answered

How much is the processing fee for your self-service platform, and what are the payment methods?

1st Capital Financial’s self-service platform, powered by Adesso360™, charges a 20% processing fee. You have the option to pay with a debit card, credit card, or PayPal account. If you use a PayPal account, you can Pay in 4 or Pay Monthly.

Money-Back Guarantee: If you do not receive your refund for any reason, we will reimburse you for any fees you have paid¹.

What is the average SETC refund individuals receive?

The average SETC refund clients receive using our self-service platform is about $9,400.

How long will it take to receive my SETC refund?

It can take up to three weeks for the IRS to acknowledge their acceptance of your SETC claim and 20 weeks for the IRS to process your SETC claim and issue your checks or direct deposit. However, our clients typically receive their refund in about nine weeks. Clients who opt for direct deposit may receive their refund even sooner.

Do I have to repay the funds I receive from the SETC?

No, the SETC is not a loan or grant. The funds you receive from the SETC are a refund against the taxes you have already paid or owe. These tax credits are intended to compensate you for the income you have lost due to COVID-19.

Are there any deadlines for claiming the SETC?

Yes, two deadlines apply to the amended tax returns required for your claim. The deadline for your 2020 amended tax return is April 15, 2024. This deadline applies to the period between April 1, 2020, and March 31, 2021, and accounts for $15,110 of the SETC value. The deadline for your 2021 amended tax return is April 15, 2025. This deadline applies to the period between April 1, 2021, and September 30, 2021, and accounts for $17,110 of the SETC value.

Additional SETC Tax Credit Resources

Find Out If You're Eligible for the SETC Tax Credit

You may be able to recover up to $32,220 as a sole proprietor, freelancer, independent contractor, or gig worker. Take our pre-qualification survey to get started.