Meeting the demand for employee benefits that attract, engage, and retain talent can be a daunting task in today’s post-Great Resignation labor market. Economic conditions are tightening benefits budgets while ballooning healthcare costs are making coverage less affordable. Businesses are seeking strategic ways to invest in their employees’ well-being and control costs. One option many turn to is employer-sponsored group health plans that promote shared accountability through employee participation.

These platforms are consistent with the intent of the Affordable Care Act (ACA), which first introduced the contribution and reimbursement models that reward accessible and affordable health, wellness, and preventative care benefits. Recent changes and guidance from government agencies have paved the way for what’s called a Wellness and Integrated Medical Plan Expense Reimbursement (WIMPER) program.

What Is a WIMPER Program?

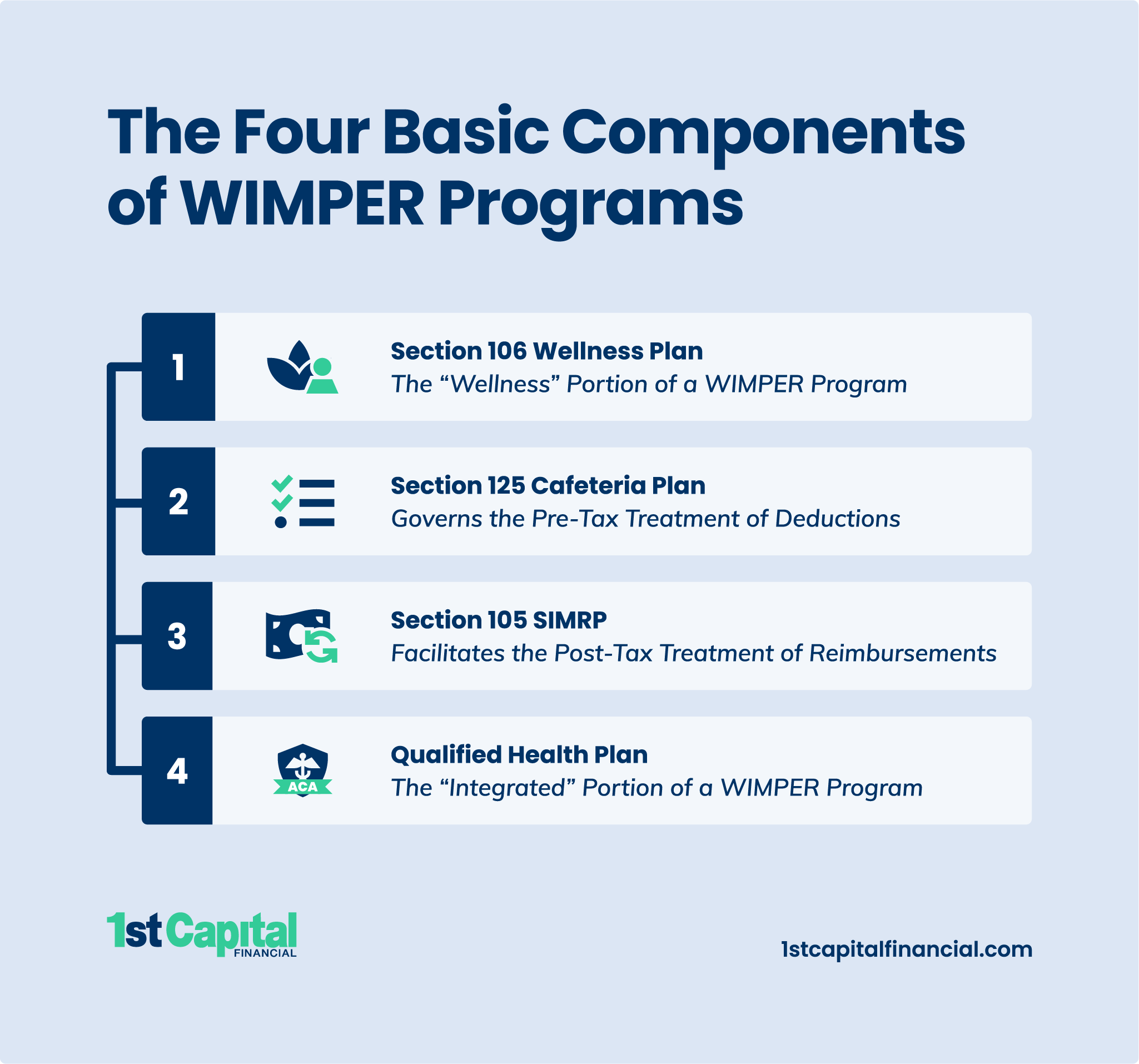

A WIMPER program is an innovative tax strategy that yields an immediate reduction of payroll expenses for employers and access to health and wellness benefits at zero net cost for employees. This is achieved through a four-part structure comprised of a Section 106 Wellness Plan, a Section 125 Cafeteria Plan, a Section 105 Self-Insured Medical Reimbursement Plan (SIMRP), and a qualified health plan.

Let’s explore the tax codes and flow of pre-tax deductions and post-tax reimbursements that make a WIMPER program possible.

Section 106 Wellness Plan

A Section 106 Wellness Plan refers to the wellness portion of a WIMPER program where the value of the plan is tax-excludable in accordance with Internal Revenue Code (IRC) § 106(a). Employees who participate receive a pre-tax deduction for the value of the plan and a post-tax reimbursement of the balance, creating an allotment of tax savings. The pre-tax treatment is governed by a Section 125 Plan, and the post-tax treatment is facilitated by a Section 105 SIMRP.

Section 125 Cafeteria Plan

A Section 125 Plan, also known as a cafeteria plan, is an employer-sponsored benefits arrangement that allows employees to apply pre-tax contributions toward two or more elected tax-free benefits. Contributions reduce employees’ taxable wages, thereby lowering their Medicare, Social Security, federal income, and state income taxes.

Similarly, pre-tax deductions reduce employers’ Federal Insurance Contributions Act (FICA) taxes, Federal Unemployment Tax Act (FUTA) taxes, State Unemployment Tax Act (SUTA) taxes, and workers’ compensation insurance premiums.

A premium-only plan (POP) is the preferred type of cafeteria plan used by most WIMPER program administrators. As the name suggests, employees’ tax savings are used exclusively to fund the insurance and insurance-equivalent premiums of qualified benefits as defined in IRC § 125(f)(1).

Section 105 SIMRP

A Section 105 SIMRP is a separate, written, employer-sponsored group health plan that allows employees to be directly reimbursed post-tax for tax-excludable medical care expenses. A Section 105 SIMRP is considered a Health Reimbursement Arrangement (HRA) and will generally supplement an existing major medical insurance policy. When a major medical insurance policy is not offered, however, employees may use a portion of their allotment to fund a Minimum Essential Coverage (MEC) plan instead.

Note: WIMPER program administrators may refer to this segment loosely as a Section 105 Plan, an Integrated 105 Plan, a Section 105 HRA, a Section 105 Preventative Care Management Program (PCMP), a Section 105 Medical Expense Reimbursement Plan (MERP), or a Self-Insured Medical Expense Reimbursement Plan (SIMERP). While differences may exist, all aim to employ post-tax reimbursements as described in IRC § 105(b), defined in IRC § 213(d), and further explained in Code of Federal Regulations (CFR) § 1.105-11.

Qualified Health Plan (QHP)

A Qualified Health Plan (QHP) is a health insurance policy that meets the requirements set forth by the ACA, such as a major medical insurance policy or a MEC plan. QHPs are requisite to many of the deductions and reimbursements made through a WIMPER program, so administrators will typically require employees without coverage to apply some of their tax savings to a MEC plan. This establishes the “integrated” portion of a WIMPER program.

Employer Mandate

The ACA requires Applicable Large Employers (ALEs), those with 50 or more full-time equivalent employees, to offer 95% or more of their full-time workers a QHP or pay a penalty. This “pay or play” rule may be satisfied, though, with a MEC plan through a WIMPER program.

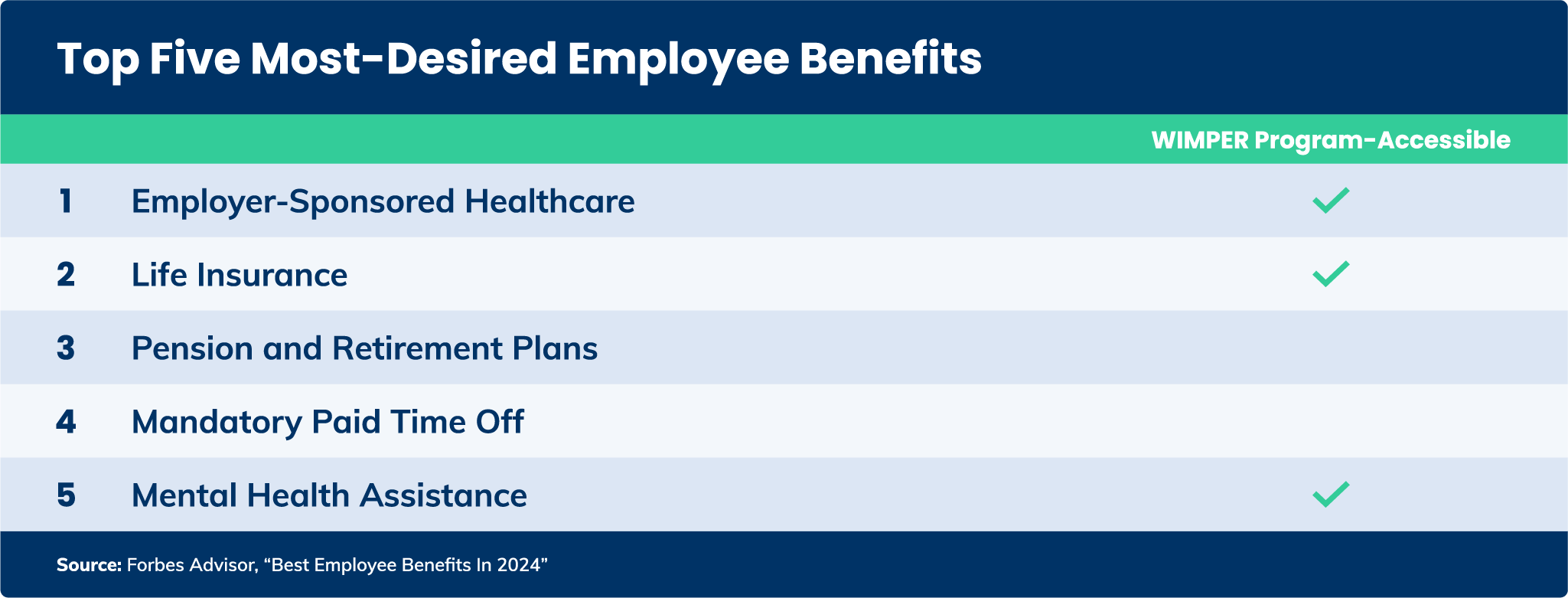

Types of Employee Benefits WIMPER Programs Offer

In addition to the tax advantages, WIMPER programs offer employees access to the benefits they genuinely value.

Wellness Plan Benefits

Examples of wellness plan benefits, often administered through a mobile app, include:

- 24/7/365 Telehealth Services

- Chronic Disease Management

- Health Education

- Health Risk Assessments

- Mental Health Services

- Prescription Benefits

- Smoking Cessation

- Virtual Primary Care

- Virtual Urgent Care

- Wellness Coaching

Accident, Health, and Life Insurance Benefits

Examples of accident, health, and life insurance benefits include:

- Accident and Short-Term Disability Insurance

- Critical Illness and Cancer Insurance

- Dental Insurance

- Group Term Life Insurance

- Hospital Insurance

- Vision Insurance

MEC Plan Benefits

MEC plans offered through a WIMPER program generally encompass most or all of the ACA’s essential health benefits (EHBs):

- Ambulatory Patient Services

- Emergency Services

- Hospitalization

- Maternity and Newborn Care

- Mental Health and Substance Use Disorder Services

- Prescription Drugs

- Rehabilitative and Habilitative Services and Devices

- Laboratory Services

- Preventative and Wellness Services and Chronic Disease Management

- Pediatric Services

Pros and Cons of WIMPER Programs

WIMPER programs produce win-win outcomes for employers and employees.

Advantages for Employers

- Reduces Payroll Tax Liability

- Decreases Workers’ Compensation Insurance Costs

- Lowers Paid Time Off (PTO) and Paid Sick Leave (PSL) Expenses

- Improves Talent Acquisition and Retention Efforts

Advantages for Employees

- Introduces Additional Benefits Without Affecting Employees’ Net Pay

- Extends a Wide Range of Meaningful Benefits to Employees’ Families

- Boosts Engagement, Productivity, and Overall Well-Being

- Lowers Healthcare Costs

Nevertheless, there are a couple of disadvantages. This statement is especially true if you intend to set up a WIMPER program for your business without the help of an administrator.

Disadvantages for Employers

Setting up a WIMPER program without the help of an administrator comes with a high risk of non-compliance. This is because WIMPER programs have extensive documentation and reporting requirements and are subject to ACA, Americans with Disabilities Act (ADA), Employee Retirement Income Security Act (ERISA), and Health Insurance Portability and Accountability Act (HIPAA) rules, and guidance from the Internal Revenue Service (IRS), Department of Labor (DOL), and Department of Health and Human Services (HHS).

Disadvantages for Employees

A WIMPER program cannot replace a major medical insurance policy. WIMPER program benefits are limited, and your employees may be unfamiliar with how they work.

Who Is Eligible to Participate In a WIMPER Program?

Eligibility to participate in a WIMPER program is primarily determined by the tax codes employed and group policy criteria.

Eligibility Requirements for Employers

Many types of employers are eligible to set up a WIMPER program, including C corporations, S corporations, limited liability companies (LLCs), partnerships, and sole proprietors. Your business must have full-time employees to generate the tax savings that fund the benefit premiums. Group policy providers may also assess a minimum employee count (e.g., two, five, or 10 employees).

There are two additional tests your business needs to satisfy for the Section 105 SIMRP portion of a WIMPER program.

- Percentage Test. The percentage test stipulates that a Section 105 SIMRP must benefit 70% or more of all employees or 80% or more of all eligible employees, provided that 70% or more are eligible.

- Classification Test. The classification test necessitates that a Section 105 SIMRP benefits all employees equally, without discrimination, in favor of highly compensated or key employees.

Eligibility Requirements for Employees

Employees can participate in a WIMPER program if they have a W2 status and work full-time—at least 30 hours per week or receive a minimum annual salary of $26,240. Employees also need a QHP.

Self-employed individuals, partners in a partnership, shareholders with 2% or more ownership in an S corporation, and some other owners are ineligible to participate per Section 125 Plan guidelines.

Other employee classifications may be excluded from consideration under Section 105 SIMRP rules. These include workers who:

- have completed less than three years of service,

- are under the age of 25,

- are part-time,

- are part of a collective bargaining agreement (e.g., a labor union or professional employer organization), or

- are nonresident aliens who don’t receive earned income.

Changing Elections During the Plan Year

Employees’ elections under a WIMPER program are normally irrevocable during the plan year, but there are exceptions. An employee may update their elections mid-year under the following three conditions:

- There’s a permitted election change event based on:

- marital status,

- number of dependents,

- employment status,

- a dependent satisfying or no longer satisfying eligibility requirements,

- change of residence,

- the initiation or termination of adoption proceedings,

- eligibility for Medicare or Medicaid,

- cost changes, or

- additions or improvements made to the benefit options.

- The employee’s update is consistent with their permitted election change event.

- Your WIMPER program’s plan documentation allows for mid-year updates.

Compliance Requirements of a WIMPER Program

WIMPER program compliance is crucial to avoid unexpected tax penalties and interest.

Essential Documentation

The architecture of a compliant WIMPER program starts with the following:

- Section 125 Cafeteria Plan Document. The Section 125 Cafeteria Plan document includes the master plan, adoption agreement, Summary Plan Description (SPD) of the benefits provided, and other ERISA-related disclosures.

- Section 105 SIMRP Document. The Section 105 SIMRP document addresses the SPD of the benefits provided, ERISA-related disclosures, and other plan information.

- PCMP Document. The PCMP document outlines the IRC § 213(d)-eligible medical expenses covered.

- Salary Reduction Agreement. The salary reduction agreement acknowledges that a participating employee agrees to make a pre-tax contribution, via a reduction of their gross income, to pay for qualified benefits.

- Annual Notices. Annual notices are issued to employees once per benefit year or whenever a substantial change is made.

Other record-keeping and legal documentation your business should consider are employment records, evidence of non-discrimination testing, corporate resolutions, legal reviews, attorney opinion letters, administrator agreements, custom forms, and additional wellness plan information.

Reporting Requirements

Reporting requirements vary but often include the following:

- Box 14 on Employees’ W-2s. Box 14 reports the non-taxable reimbursement of the Section 106 Wellness Plan.

- Form 5500. A Form 5500, part of ERISA’s reporting and disclosure framework, provides the DOL and IRS with the specifics of your WIMPER program benefit plans.

You may have other reporting requirements—such as IRS Forms 1095-B and 1095-C—depending on your business structure, the number of participants, and the benefits offered through or alongside your WIMPER program.

IRS Guidance and Public Law

Below are the majority of publications, memoranda, tax codes, U.S. Treasury regulations, and related legislation for WIMPER programs.

Source | Publications and Rules |

|---|---|

Internal Revenue Service (IRS) | |

Internal Revenue Code (IRC) | |

Code of Federal Regulations (CFR) | CFR §§ 1.105-11 and 1.125-4 |

Department of Labor (DOL) |

What To Watch Out For

Fixed Indemnity Plans

The IRS clarified in CCA Memorandum 202323006, released on June 9, 2023, that reimbursements of fixed indemnity wellness plan premiums should be included in employees’ gross income. This is consistent with the IRS’s previous memoranda in 2016 and 2017 that address “double-dipping” arrangements.

It’s worth mentioning that the IRS’s Office of Chief Counsel memoranda are interpretations and have no legal precedent—truer now that the U.S. Supreme Court has overturned Chevron deference. Although the Treasury Department proposed new legislation to amend regulations concerning the taxability of fixed indemnity wellness plans in 2023 (REG-120730-21), they withdrew their proposal in 2024. The IRS’s position, however, remains unchanged. Employers should tread cautiously and avoid fixed indemnity wellness plans if possible.

Activity-Based Programs

Like fixed-indemnity plans, the IRS’s position on activity-based wellness programs is that they don’t meet the criteria necessary to be excluded from employees’ gross wages.

This is not to be confused with participatory wellness programs in which engagement is routinely monitored, not activities or outcomes. Monitored participatory wellness programs are the foundation of a compliant WIMPER program.

Cash Reimbursements

Cash reimbursements, particularly those that significantly increase employees’ take-home pay, are taxable. This is an important point since legislation governing the tax treatment of cash reimbursements absent medical expenses is clear.

This is distinctly different from WIMPER programs in which all benefits are IRC § 213(d)-compliant medical expenses and only a nominal increase (e.g., less than $50 per paycheck) in employees’ take-home pay is ever achieved.

Wellness Plan Schemes

Wellness plan schemes and their promoters have been a recurring issue for the IRS since the passage of the ACA. Unfortunately, bad actors do exist and are not always easy to identify.

How to Set Up a WIMPER Program

1. Find a WIMPER Program Administrator or Broker

Working with a reputable WIMPER program administrator or broker, like 1st Capital Financial, is advisable. Administrators handle the documentation, enrollment, outreach, education, support, and engagement monitoring. They also work directly with your payroll and Human Resources (HR) departments to ensure compliant reporting and record-keeping.

What’s more, administrators may offer full or partial indemnification for their services, shifting the liability away from your business.

2. Book Your WIMPER Program Discovery Call

Discovery calls are an opportunity for you to get to know your WIMPER program administrator or broker, learn more about their program’s specific benefits and requirements, and help them better understand your business’s needs.

3. Complete an Employee Census Report

Census reports are an exhaustive collection of information about your employees’ classifications, tax information, existing benefits, and deductions. WIMPER program administrators use this data to prepare an accurate and comprehensive proposal of your savings, employees’ allotments, and their eligible benefits.

4. Review Your Administrator’s Proposal

WIMPER program administrators typically schedule a follow-up call to present your proposal and answer any questions.

5. Launch, Enroll, and Begin Saving

WIMPER program administrators determine an enrollment strategy and assign a launch date. Employees’ benefits kick in on the first day of the benefit month, and your savings are realized on the first payroll period of the benefit month.

FAQs About WIMPER Programs

What is the cost of adding a WIMPER program?

There’s no upfront cost associated with adding a WIMPER program if you work with an administrator or broker. You’re invoiced directly by your policy carriers after two or three payroll periods, allowing you to pay the benefit premiums using your accrued savings.

How does a WIMPER program compare to other employee wellness programs?

Most employee wellness programs don’t produce immediate or quantifiable savings and come at a considerable cost, with comparable products averaging up to $2,000 per employee per year. WIMPER programs, on the other hand, produce immediate and quantifiable savings with no out-of-pocket expense.

Will adding a WIMPER program affect my business’s existing health insurance?

WIMPER program benefits are supplemental, so there’s no interference with your business’s existing policies. You may even stack coverage to assist employees with high deductibles.

Will adding a WIMPER program affect my employees’ paychecks?

Employees’ net pay will show no change or a nominal increase but never a decrease. Additional line items on their pay stubs will reflect the pre-tax deduction and post-tax reimbursement of the Section 106 Wellness Plan and charges for elected qualified benefits.

Can a WIMPER program be used to comply with the Affordable Care Act (ACA)?

WIMPER programs can be used to comply with the ACA’s employer mandate for Applicable Large Employers (ALEs) with a Minimum Essential Coverage (MEC) plan funded with employees’ tax savings.

Start Saving With a WIMPER Program

As businesses grapple with heightened benefits expectations and economic instability, the need for low-cost strategies for improving workers’ health and well-being is paramount. WIMPER programs are uniquely positioned to fulfill this demand as they provide compelling savings for employers and meaningful benefits for employees without affecting their net pay.

A well-designed WIMPER program can make all the difference to your business’s recruitment, retention, and healthcare cost mitigation efforts. 1st Capital Financial has the capacity, experience, and network to accommodate employers with as little as five employees to those with tens of thousands, giving us a competitive edge in the industry. Be sure to submit an intake form online or give us a call to learn more.

Start Saving With WIMPER Program Benefits Today