As a business owner, employer, or payroll executive, you may be aware that the size of an organization has a major impact on the calculation of its Employee Retention Credit (ERC) claim. The ERC was established as part of legislation under the Coronavirus Aid, Relief and Economic Security Act (CARES Act) to incentivize businesses to keep their employees on payroll during the COVID-19 pandemic. In this blog post, we’ll explain how employers’ headcount classification relates to the ERC, the differences between Full-Time Employees and Full-Time Equivalent Employees, and how to apply the rules to your own business.

Small or Large Headcount Classification

When the ERC program was first enacted, Congress instituted a clear distinction between the treatment of small employers and large employers. Small employers are eligible to receive a percentage of all qualified wages paid in 2020 and 2021. Large employers, on the other hand, are only eligible to receive a percentage of qualified wages paid to employees that were not providing services in 2020 and 2021.

Let’s assume Mom & Pop LLC is a small employer and Jane is a full-time employee. Mom & Pop LLC pays Jane for 40 hours during one week in January 2021. Jane technically only worked 10 hours since Mom & Pop LLC was forced to suspend its operations due to a governmental order. In this example, Mom & Pop LLC will be able to include all 40 hours of Jane’s qualified wages in its ERC calculation.

Let’s assume ACME, Inc. is a large employer and John is a full-time employee. ACME, Inc. pays John for 40 hours during one week in January 2021. John technically only worked 10 hours since ACME, Inc. was forced to suspend its operations due to a governmental order. In this example, ACME, Inc. will exclude any hours for which John was paid and working (i.e., 10 hours). This leaves 30 hours of John’s qualified wages that ACME, Inc. will be able to include in its ERC calculation.

Note: For the purpose of calculating the ERC, “qualified wages” are meant to include employees’ salaries and healthcare expenses paid during the reference period.

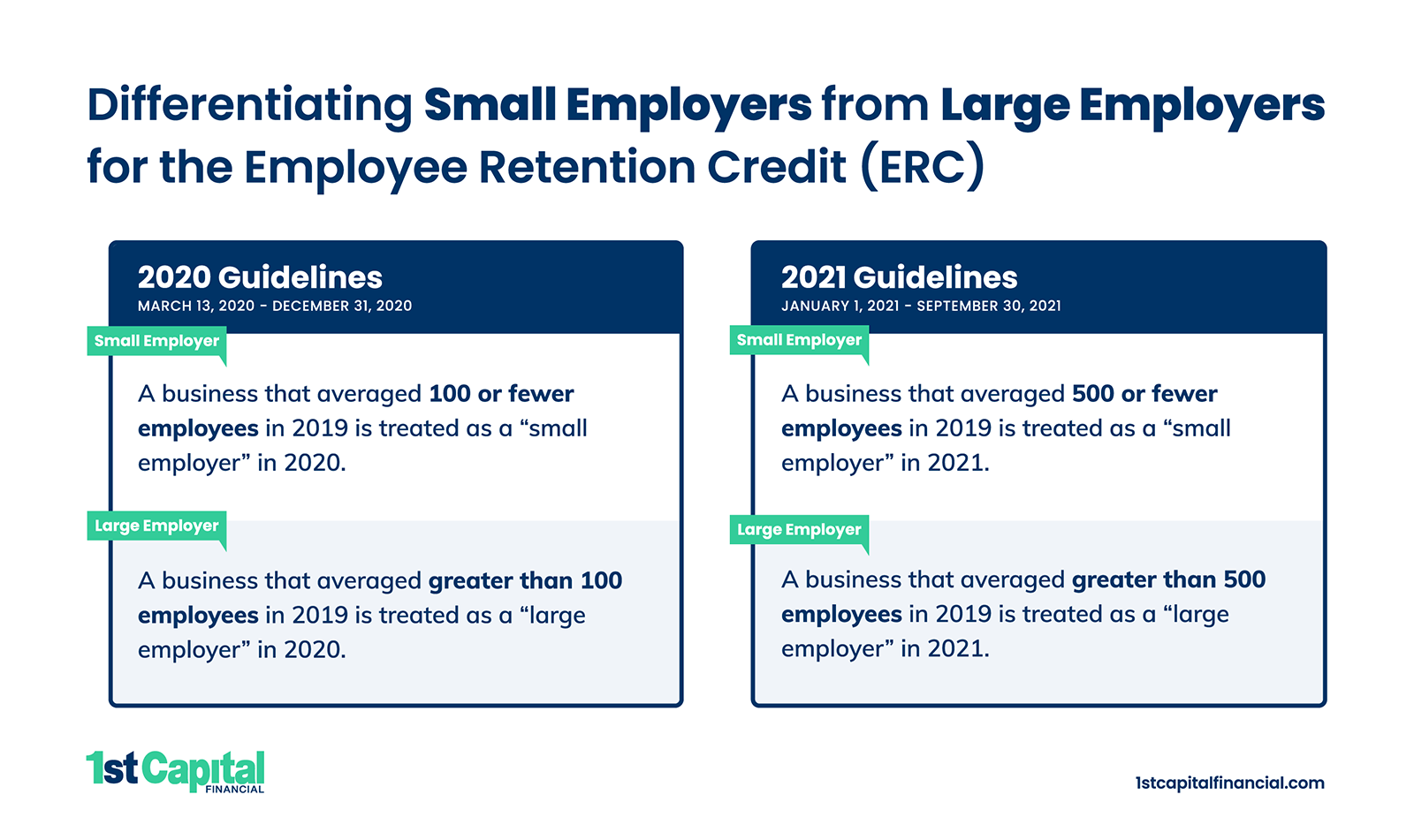

The definitions for small and large employers differ in 2020 and 2021. For 2020, an employer is considered “small” if they averaged less than 100 full-time employees in 2019, and “large” if they averaged more than 100 full-time employees. For 2021, however, an employer is considered small if they averaged less than 500 full-time employees in 2019, and large if they averaged more than 500 full-time employees.

Distinguishing Full-Time Employees

The IRS provides some guidance for distinguishing full-time employees in Notice 2021-20, Question 31 and Answer 31:

Question 31: How does an eligible employer identify the average number of full-time employees employed during 2019?

Answer 31: The term “full-time employee” means an employee who, with respect to any calendar month in 2019, had an average of at least 30 hours of service per week or 130 hours of service in the month (130 hours of service in a month is treated as the monthly equivalent of at least 30 hours of service per week), as determined in accordance with section 4980H of the Code. An employer that operated its business for the entire 2019 calendar year determines the number of its full-time employees by taking the sum of the number of full-time employees in each calendar month in 2019 and dividing that number by 12.

An employer that started its business operations during 2019 determines the number of its full-time employees by taking the sum of the number of full-time employees in each full calendar month in 2019 in which the employer operated its business and dividing that sum by the number of full calendar months in 2019 in which the employer operated its business.

An employer that started its business operations during 2020 determines the number of its full-time employees by taking the sum of the number of full-time employees in each full calendar month in 2020 in which the employer operated its business and dividing by that number of months, consistent with the approach described above for employers that began business operations during 2019.

Notice that additional instructions are provided for employers that started in 2020 and therefore cannot refer to 2019 to determine their headcount classification. In this instance, employers that started in 2020 would simply refer to the number of full-time employees they averaged in 2020 instead of 2019.

Clarification on Full-Time Equivalent Employees

For the CARES Act, Congress elected to use the term “Full-Time Employee” (FTE) as it is defined in the Affordable Care Act (ACA) — basically any employee who works either 30 hours per week or 130 hours per month. Congress’s decision to use the ACA definition has sparked a lot of debate around employers’ headcount classification for the ERC. This is because the ACA also recognizes the term “Full-Time Equivalent Employee” (FTEE).

Are FTEEs Included in Employers’ Headcount Classification for the ERC?

The simple answer is, no. Employers should not include FTEEs in their headcount classification for the ERC. This is especially beneficial to employers that would otherwise be treated as large employers if they were required to include part-time employees.

Settling the Debate Around FTEEs and the ERC

There are three reasons that employers should include FTEs, but exclude FTEEs, for the purpose of determining their headcount classification for the ERC.

- Firstly, the IRS affirms its position in Notice 2021-23, and reaffirms its position once more in Notice 2021-49 stating:

For purposes of determining whether an eligible employer is a large eligible employer or a small eligible employer, eligible employers are not required to include full-time equivalents when determining the average number of full-time employees.”

- Secondly, it is well-established that the term FTEE is not referenced by the CARES Act, nor is the term referenced in the ACA’s definition for an FTE in IRC §4980H.

- Thirdly, the language provided in IRC §4980H(c)(2)(E) expressly limits the application of FTEEs:

Solely for purposes of determining whether an employer is an applicable large employer under this paragraph, an employer shall, in addition to the number of full-time employees for any month otherwise determined, time employees determined by dividing the aggregate number of hours of service of employees who are not full include for such month a number of full-time employees for the month by 120.

This means that the concept of FTEEs applies solely to IRC §4980H(c)(2), not all of IRC §4980H.

Note: The Joint Committee on Taxation, an authoritative source of Congressional intent, disregarded the “solely for purposes of” language from IRC §4980H(c)(2)(E) in a report published on April 23, 2020, titled “Description of The Tax Provisions of Public Law 116-136, The Coronavirus Aid, Relief, And Economic Security (‘CARES’) Act.” Footnote 145 of this report suggested that employers should include FTEEs. Nevertheless, the IRS is ultimately responsible for the implementation of the law.

Final Takeaways on Employer Size

- The key distinction between small and large employers for the ERC comes down to the calculation of qualified wages. Small employers can claim all qualified wages, whereas large employers can only claim the qualified wages paid to employees that were not providing services.

- Small employers are businesses that averaged 100 or fewer employees in 2019 for 2020, and 500 or fewer employees in 2019 for 2021.

- Large employers are businesses that averaged greater than 100 employees in 2019 for 2020, and greater than 500 employees in 2019 for 2021.

- For the purposes of the ERC, an employer’s headcount classification is determined by the number of Full-Time Employees (FTEs) it averaged in 2019. Part-time employees, or Full-Time Equivalent Employees (FTEEs), are not included.

- Qualified wages are not restricted to FTEs (i.e., part-time employees’ wages are included) and are meant to account for both salary and healthcare expenses for the reference period.

Find Out If You’re Eligible for the ERC

You may be eligible for a payroll tax refund of up to $26,000.00 per employee in 2020 or 2021. This is money you’ve earned, brought to you by the company you trust. Submit an ERC application online to find out if you’re eligible or schedule an ERC consultation to learn more.