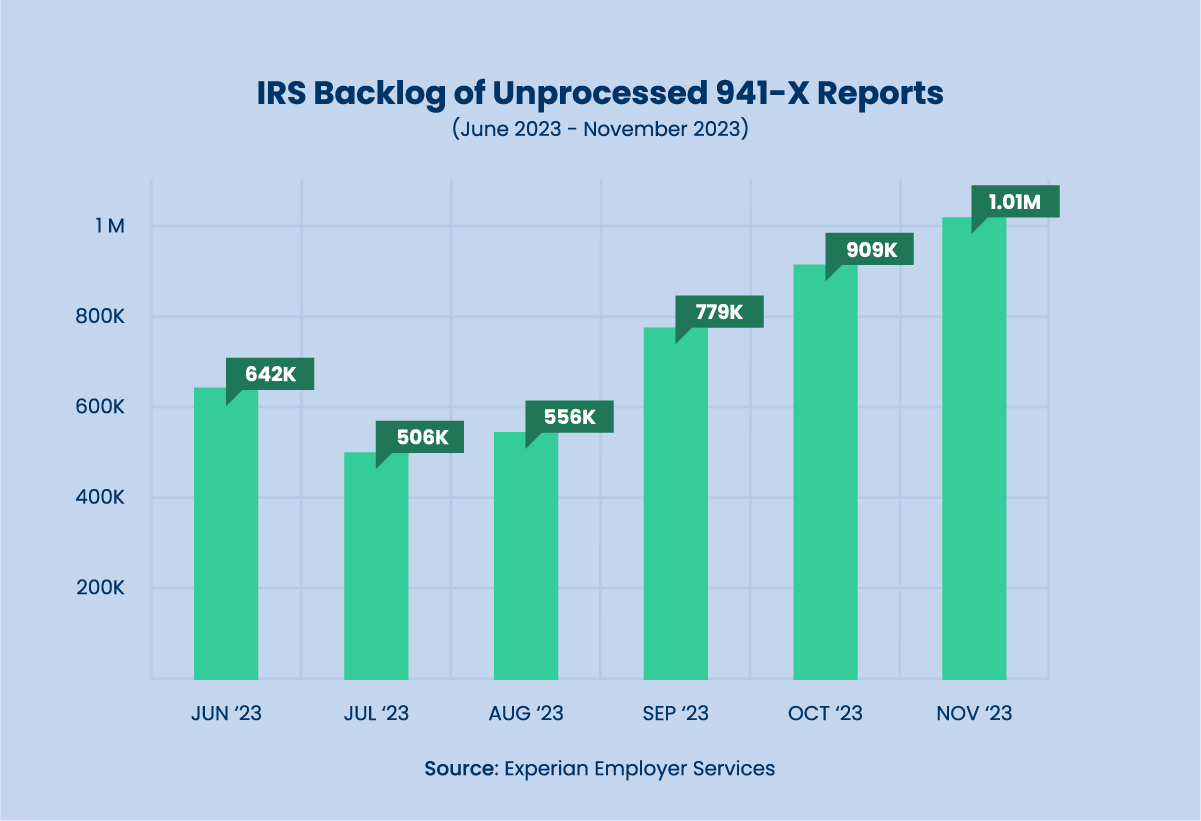

As small businesses confront ongoing challenges like cash flow shortages, supply chain issues, high interest rates, and limited access to capital, the Employee Retention Credit (ERC) has emerged as a valuable resource. However, the IRS’s moratorium on ERC processing, new “enhanced compliance review” procedure, and growing backlog of unprocessed ERC claims have contributed to extensive delays in issuing employers’ refunds.

In this article, we will explore the benefits and applications of ERC Bridge Financing. This advanced funding option gives employers immediate access to their ERC refunds without waiting on the IRS.

What is the ERC and How Does It Work?

The ERC is a refundable tax credit program introduced under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) in 2020 to incentivize employers to continue paying their employees during the COVID-19 pandemic. The IRS applies the credit to employers’ portion of social security tax and treats the excess as an overpayment.

Eligible employers are trades or businesses that experienced a full or partial shutdown from government orders or a significant decline in gross receipts.

ERC Eligibility Criteria for 2020

For the 2020 calendar year, employers are eligible for the ERC if they experienced either of the following:

- a full or partial shutdown during Q2, Q3, or Q4 from local, state, or federal government orders that limited commerce, group meetings, or travel due to COVID-19; or

- a decline in gross receipts in Q2, Q3, or Q4 of more than 50% compared to the same quarter in the previous year.

Note: Partial shutdowns are those that affected more than a nominal portion of business operations or government-ordered modifications that had more than a nominal effect on business operations.

ERC Eligibility Criteria for 2021

For the 2021 calendar year, employers are eligible for the ERC if they experienced either of the following:

- a full or partial shutdown during Q1, Q2, or Q3 from local, state, or federal government orders that limited commerce, group meetings, or travel due to COVID-19; or

- a decline in gross receipts in Q1, Q2, or Q3 of more than 20% compared to the same quarter in 2019.

Maximum ERC Value for 2020 and 2021

The value of the ERC for Q2-Q4 of 2020 is 50% of up to $10,000 in wages paid per employee. The maximum ERC value for 2020 is capped at $5,000 per employee. Conversely, the value of the ERC for Q1-Q3 of 2021 is 70% of up to $10,000 in wages paid per employee. The maximum ERC value for 2021 is $21,000 per employee. The total value of both periods is $26,000 per employee.

What is ERC Bridge Financing?

ERC Bridge Financing is an advanced funding option designed for employers who have submitted a valid ERC claim with the IRS and are awaiting processing. ERC Bridge Financing provides a cash advance on a portion of employers’ ERC refunds. Those that qualify have two funding mechanisms to consider: ERC Bridge Loans and ERC Buyouts.

ERC Bridge Loans vs. ERC Buyouts

An ERC Bridge Loan, also called an “ERC Advance Loan,” allows employers to borrow up to 85% of their ERC refund while submitting interest-only remittances each month until the IRS issues their checks. An ERC Buyout, on the other hand, allows employers to sell a portion of their ERC refund in exchange for a percentage-based fee.

Pros and Cons of ERC Bridge Loans

The advantages of an ERC Bridge Loan include:

- Lower Cost of Capital

- Quicker Access to Funds

- Employers Retain 100% of Accrued Interest on ERC Refund

The cons associated with an ERC Bridge Loan include:

- Complex Application Process

- Harder to Qualify

Pros and Cons of ERC Buyouts

The pros of an ERC Buyout include:

- No Interest or Repayment Schedule

- Less Complex Application Process

- Easier to Qualify

The disadvantages associated with an ERC Buyout include:

- Higher Cost of Capital

- Employers Do Not Retain Accrued Interest on ERC Refund

Note: Rates and terms vary by lender and employers’ qualifications.

ERC Bridge Loan | ERC Buyout | |

|---|---|---|

Funding Amount | Up to 85% of ERC Refund | Up to 84% of ERC Refund |

Approval Time | 72 Hours | 1-2 Weeks |

Interest Rate | As Low As 2% | No Interest |

Repayment Term | Until the IRS Issues ERC Refund | No Repayment Term |

Repayment Schedule | Monthly Interest-Only Remittances | No Repayment Schedule |

Benefits of ERC Bridge Financing

For many small business employers, the ERC is a substantial amount of capital to put to good use. However, the IRS stipulates a minimum wait time of six months. Employers often wait significantly longer for the IRS to process their ERC refunds and issue their checks. ERC Bridge Financing solves this problem and provides several key benefits:

- Improved Cash Flow: Employers’ immediate access to ERC funds can significantly enhance their business’s cash flow, allowing them to meet payroll demands, pay vendors, and invest in marketing or other growth opportunities.

- Business Continuity: Employers’ businesses can maintain operations without laying off employees or scaling back product or service offerings.

- Employee Retention: The primary purpose of the ERC program was to incentivize employers to retain employees. By leveraging ERC Bridge Financing, employers ensure their businesses’ workforces remain intact so that productivity and morale are unaffected.

- Potential Tax Deduction on Lender’s Fees: Some employers’ businesses may be able to offset lenders’ fees paid with ERC Bridge Financing through a tax deduction.

Eligibility Criteria for ERC Bridge Financing

To qualify for ERC Bridge Financing, employers must meet lenders’ eligibility criteria, which may include the following:

- Satisfy the IRS’s ERC Eligibility Criteria: Lenders often want to verify that employers meet the IRS’s ERC eligibility criteria before they agree to lend against or purchase employers’ claims.

- Provide Proof of IRS Form 941-X Report Submission(s): Lenders frequently want proof that the IRS has received employers’ IRS Form 941-X reports.

- Minimum ERC Refund of $75,000 or $100,000: Lenders require that employers’ ERC refund amounts are at least $75,000 for ERC Buyouts and at least $100,000 for ERC Bridge Loans.

- Operating Since February 2020 or Earlier: Lenders mandate that employers’ businesses have been operating since at least February 2020 and are still operating.

- Minimum FICO Score of 500 or 600: Lenders also require that employers have a minimum credit score of 500 for ERC Buyouts and 600 for ERC Bridge Loans.

- No Tax Liens or Judgements: Lenders will want to double-check for existing tax liens or judgments that may affect employers’ refund amounts.

ERC Bridge Loan | ERC Buyout | |

|---|---|---|

Minimum ERC Refund | $100,000 | $75,000 |

Minimum FICO Score | Up to 85% | Up to 84% |

Additional Criteria | Satisfy the IRS’s ERC Eligibility Criteria, Provide Proof of IRS Form 941-X Report Submission(s), Operating Since February 2020 or Earlier, No Tax Liens or Judgements | Satisfy the IRS’s ERC Eligibility Criteria, Provide Proof of IRS Form 941-X Report Submission(s), Operating Since February 2020 or Earlier, No Tax Liens or Judgements |

How to Apply for ERC Bridge Financing

Step #1: File an ERC Claim with the IRS

If you haven’t done so, the first step is to file your ERC claim. Businesses can file independently or through a credible third party like 1st Capital Financial. To file your ERC claim with 1st Capital Financial, submit an ERC Intake Form online or book a meeting.

Step #2: Find a Suitable ERC Lender

ERC Bridge Financing is not available through traditional banks or many small business lenders. Research lenders that offer ERC Bridge Financing and thoroughly examine their credentials. To apply for ERC Bridge Financing with 1st Capital Financial, submit an ERC Financing Form online.

Step #3: Gather Required Documentation

- ERC Financing Application (If Applying through 1st Capital Financial)

- Third-Party ERC Agreements and Calculations (If Applicable)

- IRS Form 941s and IRS Form 941-Xs for Each Quarter Claimed

- IRS Form 8821 and 7216 Consent Forms

- Copies of Income Tax Returns

- Previous Three Months’ Bank Statements

- Identification (e.g., Driver’s License or Passport) for All 20% or Greater Shareholders

Lenders may also request the following documentation:

- Debt Schedule

- Profit and Loss (P&L) and Balance Sheet

- IRS Form W-9 for the Authorized Signer

- Copies of Articles of Incorporation and Bylaws, or Operating Agreement

- Voided Check

Step #4: Consult with an ERC Financing Expert

If you are applying through 1st Capital Financial, our ERC financing team will contact you to discuss your application, the timeline to receive funds, the funding amount you qualify for, and any associated fees. We also encourage you to reach out anytime if you have questions.

Step #5: Accept Terms and Receive Funds

Once the lender approves your application and you accept the terms, they will typically release your funds within 24 hours. However, some banks can take up to three business days.

FAQs About ERC Bridge Financing

No. There are no limitations on how qualifying employers use the funds they receive from ERC funding options (i.e., ERC Advance Loans or ERC Buyouts).

Yes, ERC loans are secured against employers’ anticipated ERC refund amount. Personal guarantees may also apply depending on the viability of employers’ businesses, creditworthiness, and other factors.

Pre-approvals can take as little as 24 hours, but the time it takes to receive funds for an ERC Buyout or an ERC loan is closer to one to two weeks. ERC Buyouts can be faster. Turnarounds are primarily determined by applicants’ responsiveness to requests for documentation or information and lenders’ capabilities.

Lenders’ requirements for ERC Advance Loans and ERC Buyouts vary but generally include the following:

- Satisfy the IRS’s ERC Eligibility Criteria

- Proof of IRS Form 941-X Report Submission(s)

- Minimum ERC Refund of $75,000 (ERC Buyout) or $100,000 (ERC Advance Loan)

- Minimum Credit Score of 500 (ERC Buyout) or 600 (ERC Advance Loan)

- No Tax Liens or Judgements

The IRS will include accrued interest when issuing employers’ ERC refunds based on the dates the refund amount applies and their processing time. This IRS-paid interest accounts for the time value of outstanding ERC balances with the agency.

Employers must wait longer than ever for the IRS to issue ERC refunds. This delay is partly due to the IRS’s ERC moratorium, new processing procedures, and significant backlog of unprocessed 941-X reports. ERC Bridge Financing allows employers to access their refunds in days and use them wherever needed at a lower cost than traditional financing options.

Final Thoughts on ERC Bridge Financing

The ERC and ERC Bridge Financing are a compelling combination for financial support to those who qualify. By understanding the benefits, eligibility criteria, application process, and other considerations, employers can make an informed decision about whether ERC Bridge Financing is right for them.

1st Capital Financial has served over 90,000 small businesses, delivered over $100 million in funding, and recovered over $10 billion in tax refunds since the start of the COVID-19 pandemic. Our ERC Filing Service and ERC Bridge Financing products are available to any businesses that wish to apply.

Get an Advance on Your ERC Refund