Borrow Cash While Holding Your Crypto

Receive USDC or USDT in a preferred exchange account or wallet in minutes with a crypto-backed loan.

Up to 86%+

Low as 3.80%

Automated

1st Capital Financial Is Your One-Stop Marketplace for Crypto Loans

Easy-to-Use Platform

Instant Funding

Safe and Secure

Control and Ownership

Advanced Tools

Competitive Rates

What Is a Crypto Loan?

At A Glance

A crypto loan can be used for investments, major expenses, debt consolidation, everyday business purposes, and personal needs.

Use Cases

What Can a Crypto Loan Be Used For?

Requirements for Crypto-Backed Loans

Is a Crypto Loan Right for You?

DeFi lending protocols have fewer criteria than CeFi and conventional lenders.

Minimum Criteria

How to Apply for a Crypto-Backed Loan

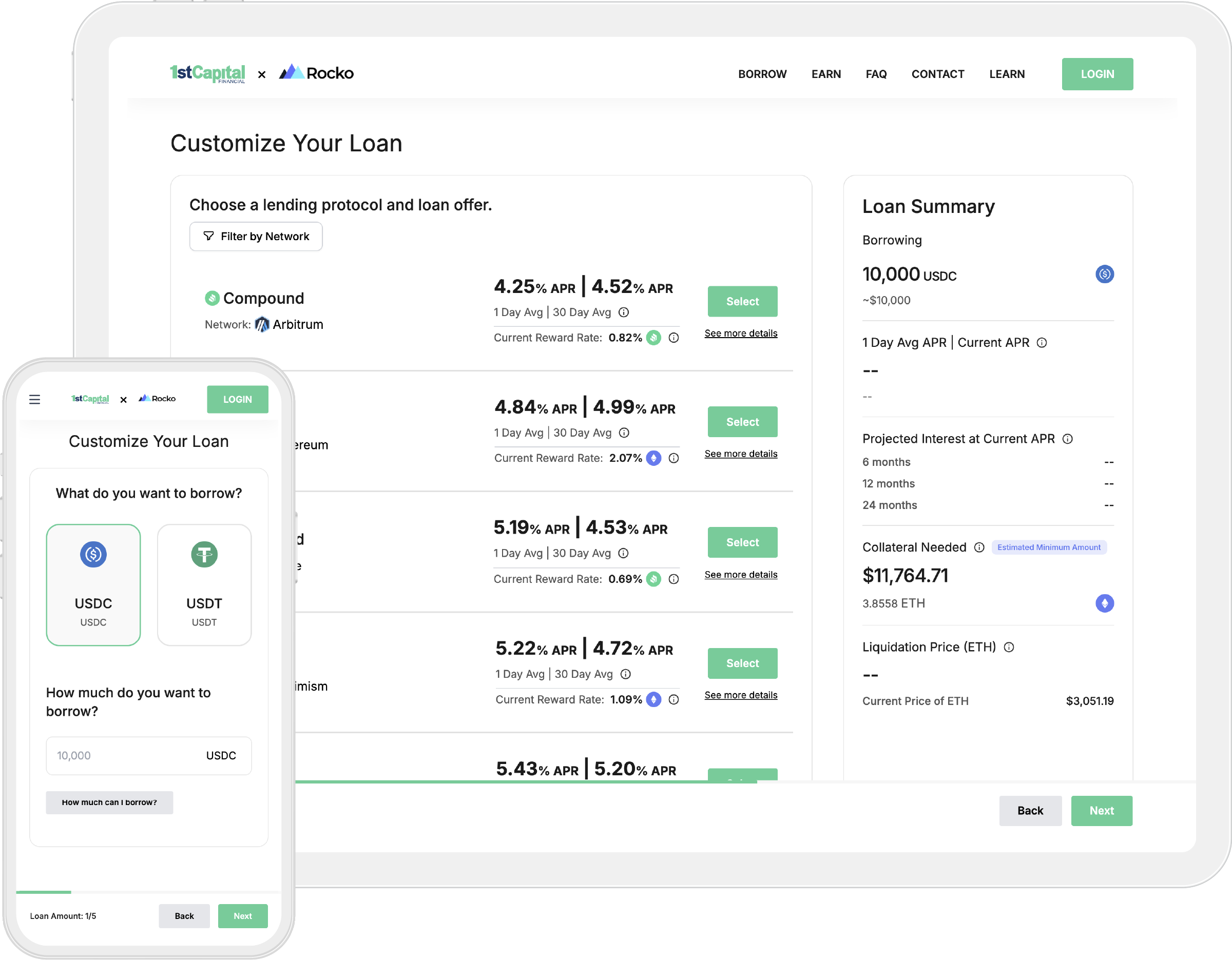

Using Our Crypto Marketplace Platform

Set Up Your Crypto-Backed Loan

Await Your Smart Wallet

Transfer Your Collateral

Receive Your Crypto-Backed Funds

DeFi Lenders on Our Marketplace v. CeFi Lenders

DeFi Lenders on Our Marketplace (Aave, Compound, MarginFi, and Morpho) | CeFi Lenders (Arch, Figure, and Ledn) | |

|---|---|---|

Supported Assets | ETH, SOL, AAVE, cbBTC, cbETH, LINK, tBTC, UNI, USDT, wBTC, and stETH | BTC, ETH, or SOL |

Interest Rates | Low as 3.80% APR at 86%+ LTV | Low as 11.00% APR at 50% LTV or 12.62% APR at 75% LTV |

Service Fee | 2% | 1-2% |

Custodian | Non-Custodial (i.e., Self-Custody) | Anchorage or BitGo |

Term Length | No Repayment Terms | 1 Year or Up to 2 Years |

Restricted U.S. States | No Restrictions | DC, ID, IL, KY, MD, MS, SD, TX, VT, VA, and Others |

We  What

What

We Do

90,000+

10 Billion+

30 Years+

90%+

FAQs About Crypto-Backed Loans

Questions? We Have Answers.

Which cryptocurrency assets are eligible for collateralization?

1st Capital Financial’s marketplace currently supports Ether (ETH), Solana (SOL), Aave (AAVE), Coinbase Wrapped Bitcoin (cbBTC), Coinbase Wrapped Staked ETH (cbETH), Chainlink (LINK), Threshold Bitcoin (tBTC), Uniswap (UNI), Tether (USDT), Wrapped Bitcoin (WBTC), and LIDO Wrapped Staked ETH (stETH). Collateral options vary based on the protocol and network. More eligible assets will be available soon.

How does an LTV ratio work for a crypto-backed loan?

A loan-to-value (LTV) ratio is equal to your loan amount divided by the value of your collateral. Crypto-backed loans are “over-collateralized” as a buffer to protect borrowers from liquidation events. LTV ratios determine how much you can borrow and your level of risk exposure. They’re also updated in real time, so you should pay close attention to LTV before and after taking out a crypto-backed loan.

Will a crypto loan impact my credit score?

Not at all! There’s no hard or soft credit check when you apply for a crypto-backed loan with any of the lending protocols supported in our marketplace, and DeFi lenders don’t report to credit agencies.

How does a crypto loan work?

A cryptocurrency (“crypto”) loan allows you to collateralize your assets and receive up to 86% [or more] of the value in USDC or USDT instantly. Simply input the amount you want to borrow, the stablecoin you want to receive, and the crypto asset you want to collateralize. Then, shop and compare competitive interest rates and reward offers from multiple lending protocols. You set the terms of your loan and retain custody and ownership with a smart wallet we provide you. You’re able to manage, modify, or refinance your loan anytime in a few clicks.

What lending protocols and networks do you support?

Our platform currently supports four decentralized finance (DeFi) lending protocols, including Aave V3 (Ethereum, Base, Optimism, and Polygon), Compound III (Ethereum, Base, Optimism, and Polygon), MarginFi V2 (Solana), and Morpho V2 (Ethereum and Base). More protocols and networks will be available soon.

How are interest rates calculated for crypto loans?

Decentralized finance (DeFi) lending protocols utilize “floating” interest rates that fluctuate in real-time based on market conditions. This is markedly different from variable interest rates in conventional lending, which are pegged to a benchmark or index (e.g., the Federal Reserve’s prime rate or optional peg rate). In DeFi lending, floating interest rates are calculated formulaically by lending protocols. These rates are dynamic, responsive, and often lower than those seen in centralized finance (CeFi) or conventional loans.

What are the tax implications of securing a crypto loan?

Borrowing against crypto assets is not considered a taxable event so long as they are not converted or sold under current Internal Revenue Service (IRS) guidelines. Notably, the IRS has not issued guidance for wrapped tokens. While the tax implications are generally favorable, borrowers should consult with a tax professional for advice and further insight.

Who can apply for a crypto loan?

Any business entity, entrepreneur, or individual with cryptocurrency (“crypto”) assets can apply for a loan. There are no additional criteria or credit requirements.

What happens if I don't repay my crypto-backed loan?

If the balance of your loan exceeds the maximum loan-to-value (LTV) ratio or “liquidation threshold,” whether it’s because you choose not to repay or for another reason, your collateral could be liquidated, and the lending protocol may collect a fee. Liquidation events and fees are easy to avoid so long as you monitor your LTV and pay the interest or deposit more collateral. We recommend you set up email and text alerts to reduce risk.

Do More With Your Crypto Portfolio

Access the liquidity you need today with a crypto-backed loan.